How Our Buyers Avoid Overpaying & Our Sellers Close in Record Time.The Secret is Our System for Buying Under Budget and Selling Over Asking.

Click below to schedule a FREE Real Estate Strategy Call with one of our real estate experts

Tired of Guessing in the GTA Market? Let Team Hashim Ashraf Navigate It For You

How Our Buyers Avoid Overpaying & Our Sellers Close in Record Time.The Secret is Our System for Buying Under Budget and Selling Over Asking.

Click below to schedule a FREE Real Estate Strategy Call with one of our real estate experts

Tired of Guessing in the GTA Market? Let Team Hashim Ashraf Navigate It For You

About Hashim Ashraf

Hi, I'm Hashim Ashraf. In a market as dynamic and complex as the GTA, you need more than just a realtor, you need a strategist, a marketer, a guide, and a dedicated coach.

I've built my reputation not on empty promises, but on a foundation of honesty, relentless dedication, and delivering real results. I understand that "Home" means something different to everyone—whether it's a first-time purchase, a lucrative investment, a fixer-upper with potential, or securing your spot in a sought-after pre-construction project. My clients come from all walks of life because I speak your language—whether you're buying in Mississauga Oakville, Milton, Brampton, Durham region, or exploring markets outside the GTA such as Great horseshoe area or KWC Region we have got you covered. My mission is to connect you with the right opportunity and turn your real estate goals into reality.

About Hashim Ashraf

Hi, I'm Hashim Ashraf. In a market as dynamic and complex as the GTA, you need more than just a realtor, you need a strategist, a marketer, a guide, and a dedicated coach.

I've built my reputation not on empty promises, but on a foundation of honesty, relentless dedication, and delivering real results. I understand that "Home" means something different to everyone—whether it's a first-time purchase, a lucrative investment, a fixer-upper with potential, or securing your spot in a sought-after pre-construction project. My clients come from all walks of life because I speak your language—whether you're buying in Mississauga Oakville, Milton, Brampton, Durham region, or exploring markets outside the GTA such as Great horseshoe area or KWC Region we have got you covered. My mission is to connect you with the right opportunity and turn your real estate goals into reality.

Our Services

Our Services

What I Can Help You With:

First-Time Home Buyers – Demystify the entire process. From mortgages to closing, I'll ensure you're confident and informed.

Zero Down Payment* Program- Book a call with us to know more details

Investment Properties – Maximize ROI with carefully selected opportunities.Identify properties with strong cash flow and appreciation potential, building your wealth through real estate.

Renovation Projects -Find hidden gems, understand true after-repair value, and avoid costly mistakes.

Pre-Construction Homes – Get access to the best new developments and navigate the complex purchase process with an expert.

Our Services

Our Services

What I Can Help You With:

First-Time Home Buyers – Demystify the entire process. From mortgages to closing, I'll ensure you're confident and informed.

Zero Down Payment* Program- Book a call with us to know more details

Investment Properties – Maximize ROI with carefully selected opportunities. Identify properties with strong cash flow and appreciation potential, building your wealth through real estate.

Renovation Projects -Find hidden gems, understand true after-repair value, and avoid costly mistakes.

Pre-Construction Homes – Get access to the best new developments and navigate the complex purchase process with an expert.

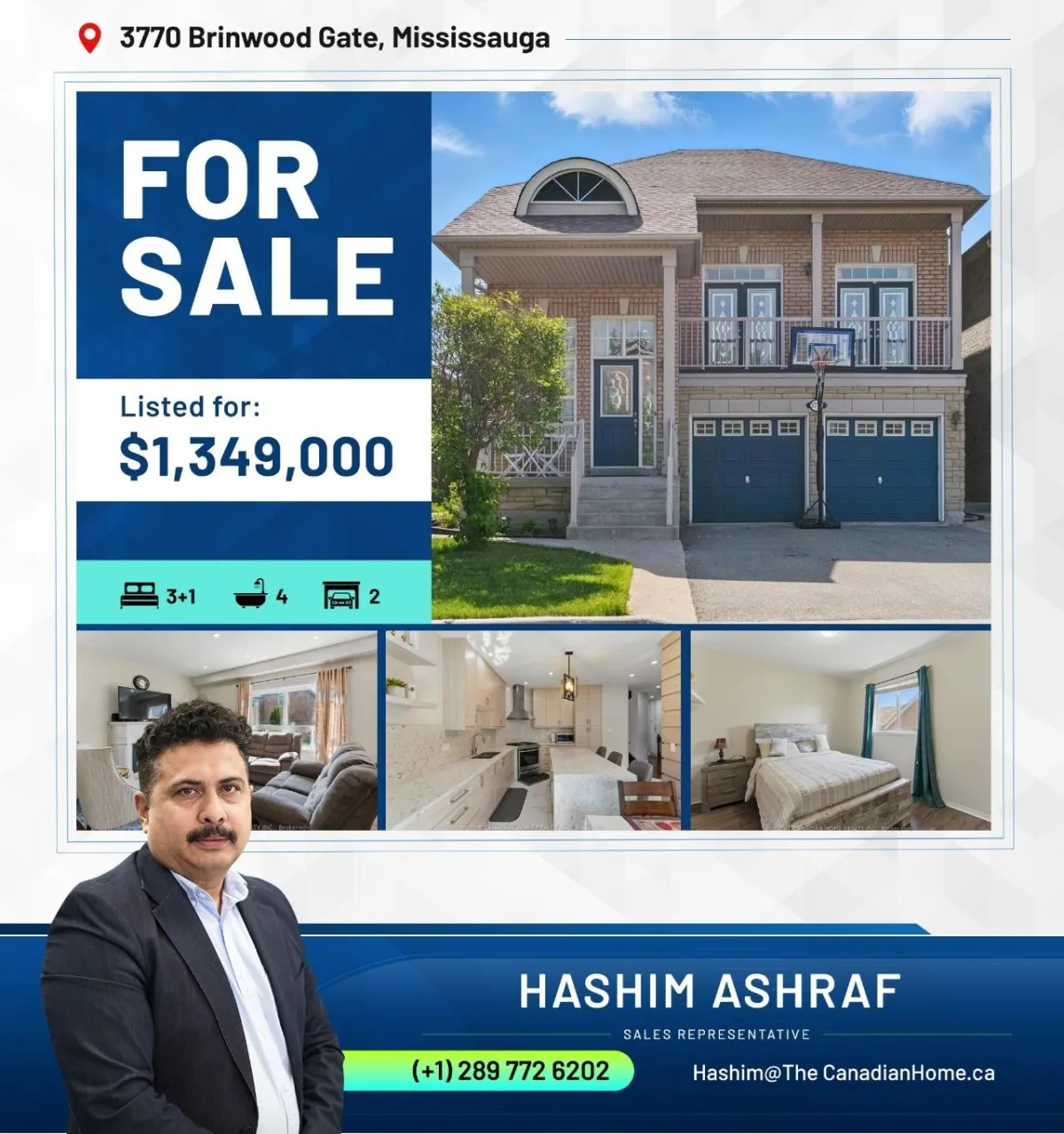

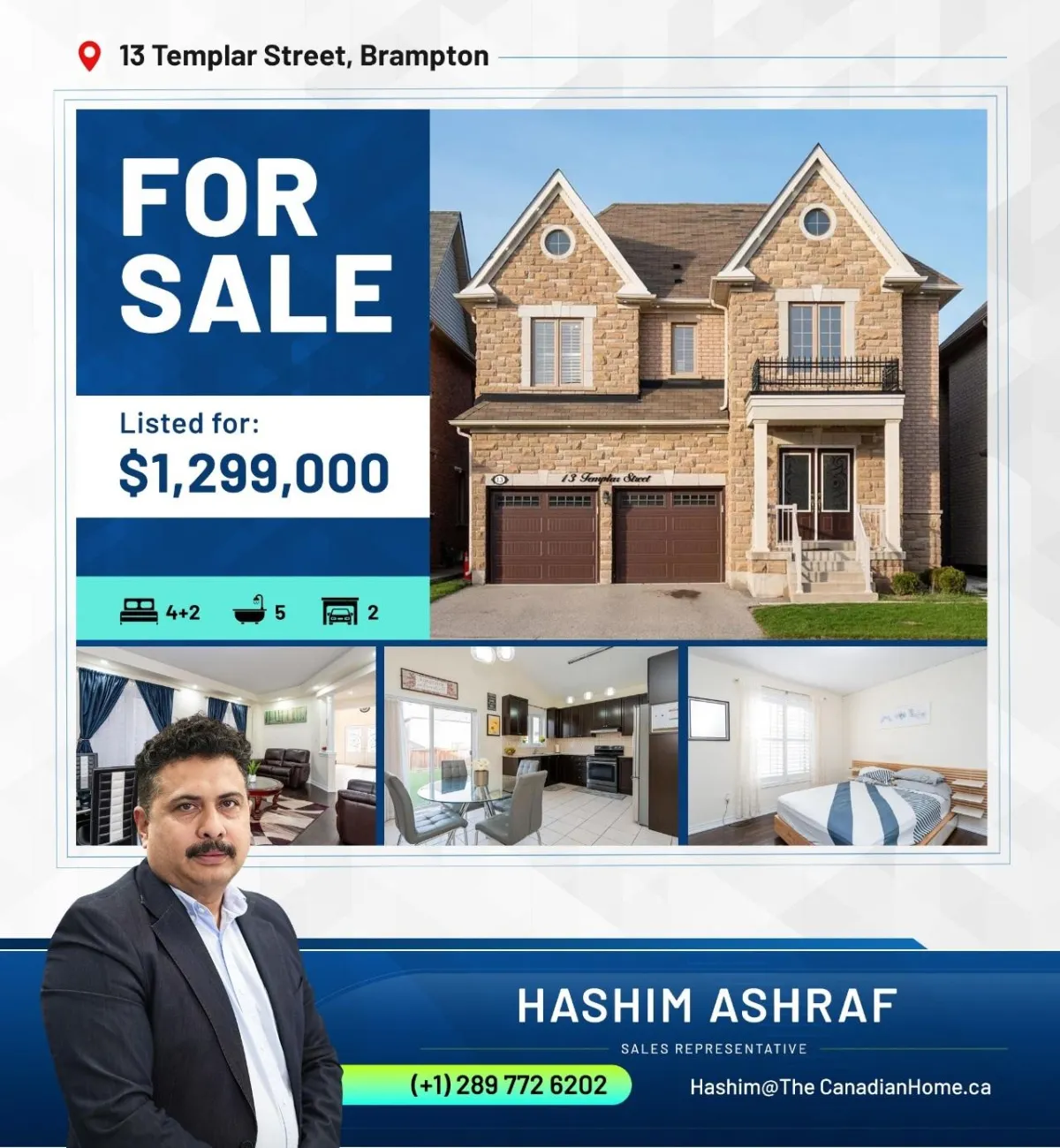

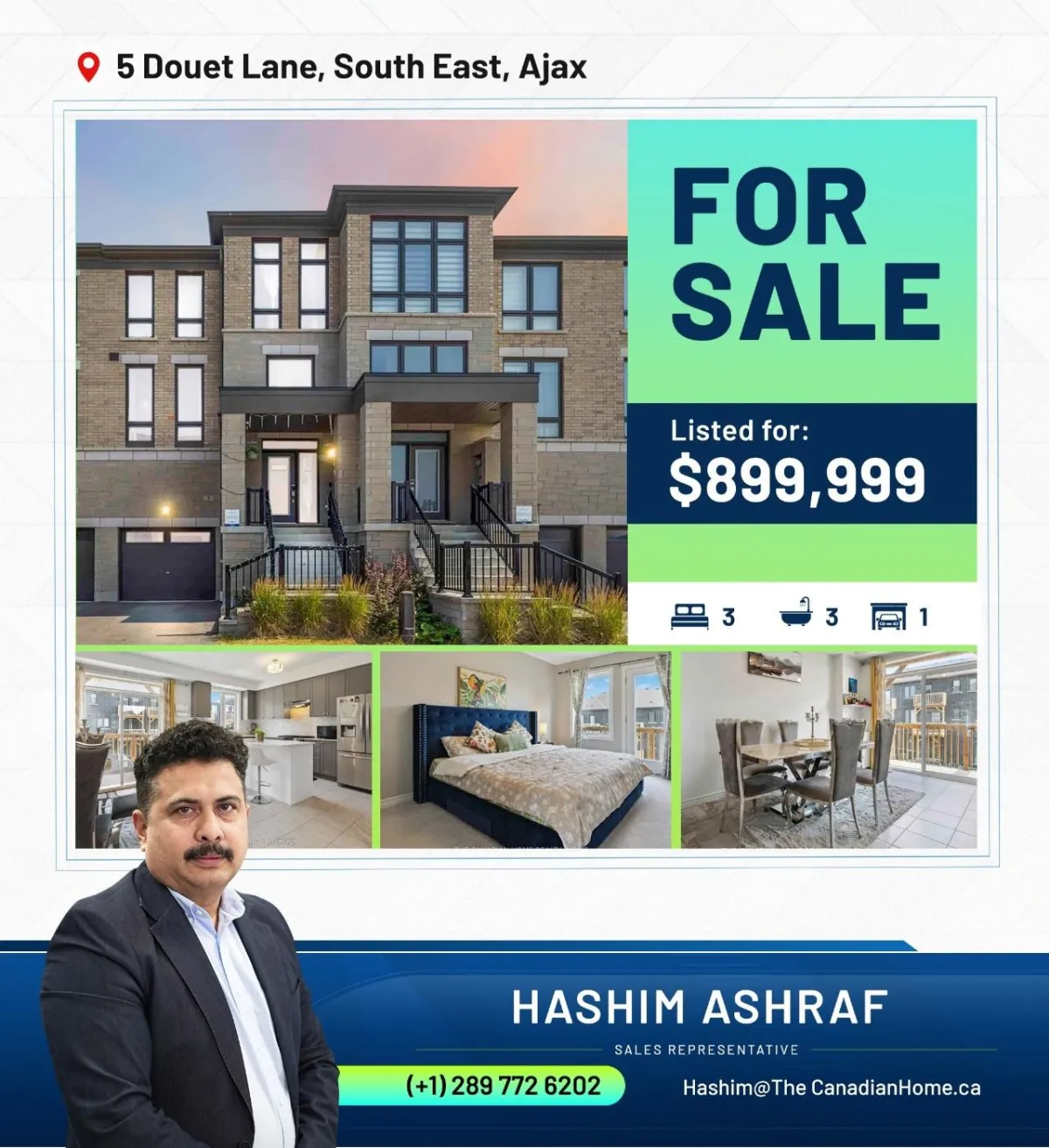

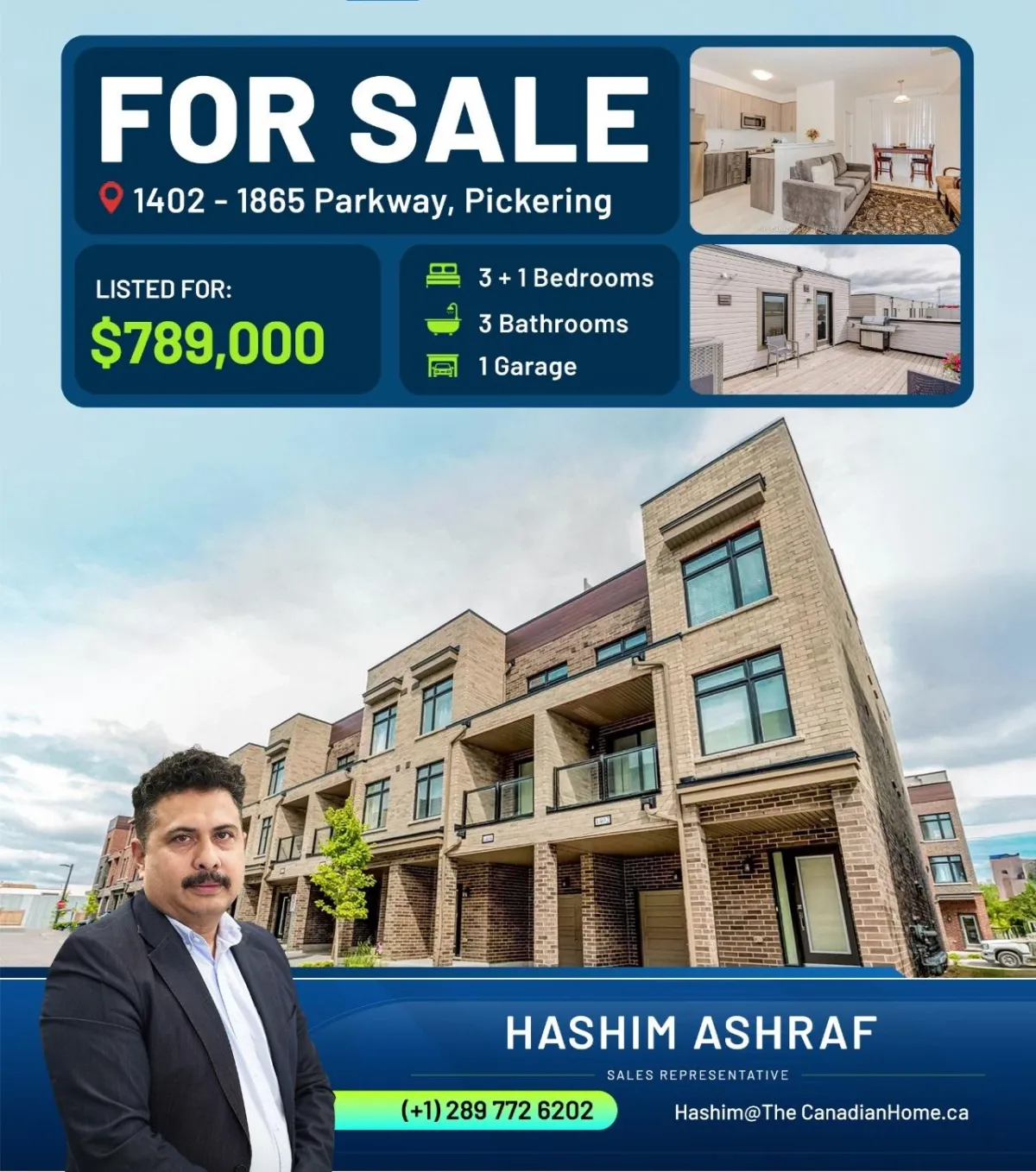

Featured Listings

Featured Listings

Discover Premium Listings in GTA & Across Ontario: From Move-In Ready to Future Opportunities.

Featured Listings

Featured Listings

Discover Premium Listings in GTA & Across Ontario: From Move-In Ready to Future Opportunities.

Why Work with Team Hashim Ashraf

Why Work with Team Hashim Ashraf

“Discipline is the bridge between goals and accomplishment.”📞 Book your FREE Strategy Session now

Why Work with Team Hashim Ashraf

What Clients Say

Hear from satisfied clients who trusted Hashim Ashraf with their real estate needs.

What Clients Say

Hear from satisfied clients who trusted Hashim Ashraf with their real estate needs.

MEET MY TEAM

MEET MY TEAM

MEET MY TEAM

MEET MY TEAM

FAQ

FAQ

1. What’s the current housing market like in Ontario?

Ontario’s housing market has cooled in 2025—average home prices dropped 6–9% year-over-year, depending on the property type (e.g., single-family at ~$782K, condos ~$530K)

However, sales activity remains robust, with July 2025 volumes up by over 11% compared to 2024

Takeaway: Buyers now have more negotiating power, and market activity signals a balanced environment. Sellers can still find motivated buyers, but pricing and timing are key.

2. Is 2025 a good time to buy or sell?

Yes—for both. Buyers benefit from softer prices and higher inventory. Sellers still see good demand, especially if their homes are well-priced and marketed effectively

Takeaway: Strategic pricing matters—buyers can find value, and sellers can still move properties efficiently if they’re competitive

3. How can buyers save on interest or be better positioned to buy?

Mortgage rates have stabilized, and Bank of Canada rate are coming down making a favourable mortgage market, with variable rates remaining attractive.

Getting a pre-approval strengthens your offer and clarifies your budget.

Takeaway: Secure pre-approval and carefully compare fixed vs. variable options to maximize affordability.

4. What are the minimum down payment requirements in Ontario?

Under $500,000: at least 5%.

$500,000–$999,999: 5% on the first $500K, 10% on the remainder.

Over $1M: 20% mandatory

Low down payments (<20%) trigger mortgage insurance, adding to your cost.

5. What closing costs should buyers expect in Ontario?

Closing costs typically run 1.5–4% of the purchase price and include:

Land Transfer Tax (provincial and possibly municipal),

Legal fees,

Title insurance,

Inspection, appraisal, and other miscellaneous fees

First-time buyers may qualify for rebates on Land Transfer Tax.

6. What provincial incentives exist for first-time home buyers?

Ontario buyers can tap into:

First-Time Home Buyer Tax Credit, land transfer fee rebate

Programs like FHSA (First Home Savings Account) or RRSP Home Buyers’ Plan for down payment savings

7. Is it better to rent or buy in today’s Ontario market?

While rent offers flexibility, buying remains a powerful wealth-building strategy, with equity gains and stability—especially in high-demand regions like the GTA.

Takeaway: For those prepared financially, buying generally offers long-term benefits over renting.

8. Do foreign nationals face restrictions when buying in Ontario?

Yes—non-residents must pay the Non-Resident Speculation Tax (NRST) of 25% in specific regions and may face tougher mortgage terms, like higher down payments (often 35%+) or needing strong credit documentation

9. How long does the buying or selling process take?

From start to finish:

Buying: 2–4 months—1–2 months for house hunting and offer prep, followed by 30–60 days from accepted offer to closing.

Takeaway: Build realistic expectations—set your timeline to accommodate financing and closing processes.

10. How are new housing policies shaping the market?

Ontario has introduced housing-friendly policies like reduced development charges, expanded land use (e.g., fourplexes and mid-rise buildings along transit lines), and potential property tax relief for first-time buyers and seniors—all designed to boost supply and improve affordability

Federal and provincial agreements have also injected funding into affordable housing projects

Takeaway: These changes may ease affordability over time and create more opportunities, especially for buyers and developers focused on emerging communities.

FAQ

FAQ

1. What’s the current housing market like in Ontario?

Ontario’s housing market has cooled in 2025—average home prices dropped 6–9% year-over-year, depending on the property type (e.g., single-family at ~$782K, condos ~$530K)

However, sales activity remains robust, with July 2025 volumes up by over 11% compared to 2024

Takeaway: Buyers now have more negotiating power, and market activity signals a balanced environment. Sellers can still find motivated buyers, but pricing and timing are key.

2. Is 2025 a good time to buy or sell?

Yes—for both. Buyers benefit from softer prices and higher inventory. Sellers still see good demand, especially if their homes are well-priced and marketed effectively

Takeaway: Strategic pricing matters—buyers can find value, and sellers can still move properties efficiently if they’re competitive

3. How can buyers save on interest or be better positioned to buy?

Mortgage rates have stabilized, and Bank of Canada rate are coming down making a favourable mortgage market, with variable rates remaining attractive.

Getting a pre-approval strengthens your offer and clarifies your budget.

Takeaway: Secure pre-approval and carefully compare fixed vs. variable options to maximize affordability.

4. What are the minimum down payment requirements in Ontario?

Under $500,000: at least 5%.

$500,000–$999,999: 5% on the first $500K, 10% on the remainder.

Over $1M: 20% mandatory

Low down payments (<20%) trigger mortgage insurance, adding to your cost.

5. What closing costs should buyers expect in Ontario?

Closing costs typically run 1.5–4% of the purchase price and include:

Land Transfer Tax (provincial and possibly municipal),

Legal fees,

Title insurance,

Inspection, appraisal, and other miscellaneous fees

First-time buyers may qualify for rebates on Land Transfer Tax.

6. What provincial incentives exist for first-time home buyers?

Ontario buyers can tap into:

First-Time Home Buyer Tax Credit, land transfer fee rebate

Programs like FHSA (First Home Savings Account) or RRSP Home Buyers’ Plan for down payment savings

7. Is it better to rent or buy in today’s Ontario market?

While rent offers flexibility, buying remains a powerful wealth-building strategy, with equity gains and stability—especially in high-demand regions like the GTA.

Takeaway: For those prepared financially, buying generally offers long-term benefits over renting.

8. Do foreign nationals face restrictions when buying in Ontario?

Yes—non-residents must pay the Non-Resident Speculation Tax (NRST) of 25% in specific regions and may face tougher mortgage terms, like higher down payments (often 35%+) or needing strong credit documentation

9. How long does the buying or selling process take?

From start to finish:

Buying: 2–4 months—1–2 months for house hunting and offer prep, followed by 30–60 days from accepted offer to closing.

Takeaway: Build realistic expectations—set your timeline to accommodate financing and closing processes.

10. How are new housing policies shaping the market?

Ontario has introduced housing-friendly policies like reduced development charges, expanded land use (e.g., fourplexes and mid-rise buildings along transit lines), and potential property tax relief for first-time buyers and seniors—all designed to boost supply and improve affordability

Federal and provincial agreements have also injected funding into affordable housing projects

Takeaway: These changes may ease affordability over time and create more opportunities, especially for buyers and developers focused on emerging communities.

Ready to Buy or Sell Your Next Property?

Ready to Buy or Sell Your Next Property?

Facebook

Youtube

LinkedIn

Website